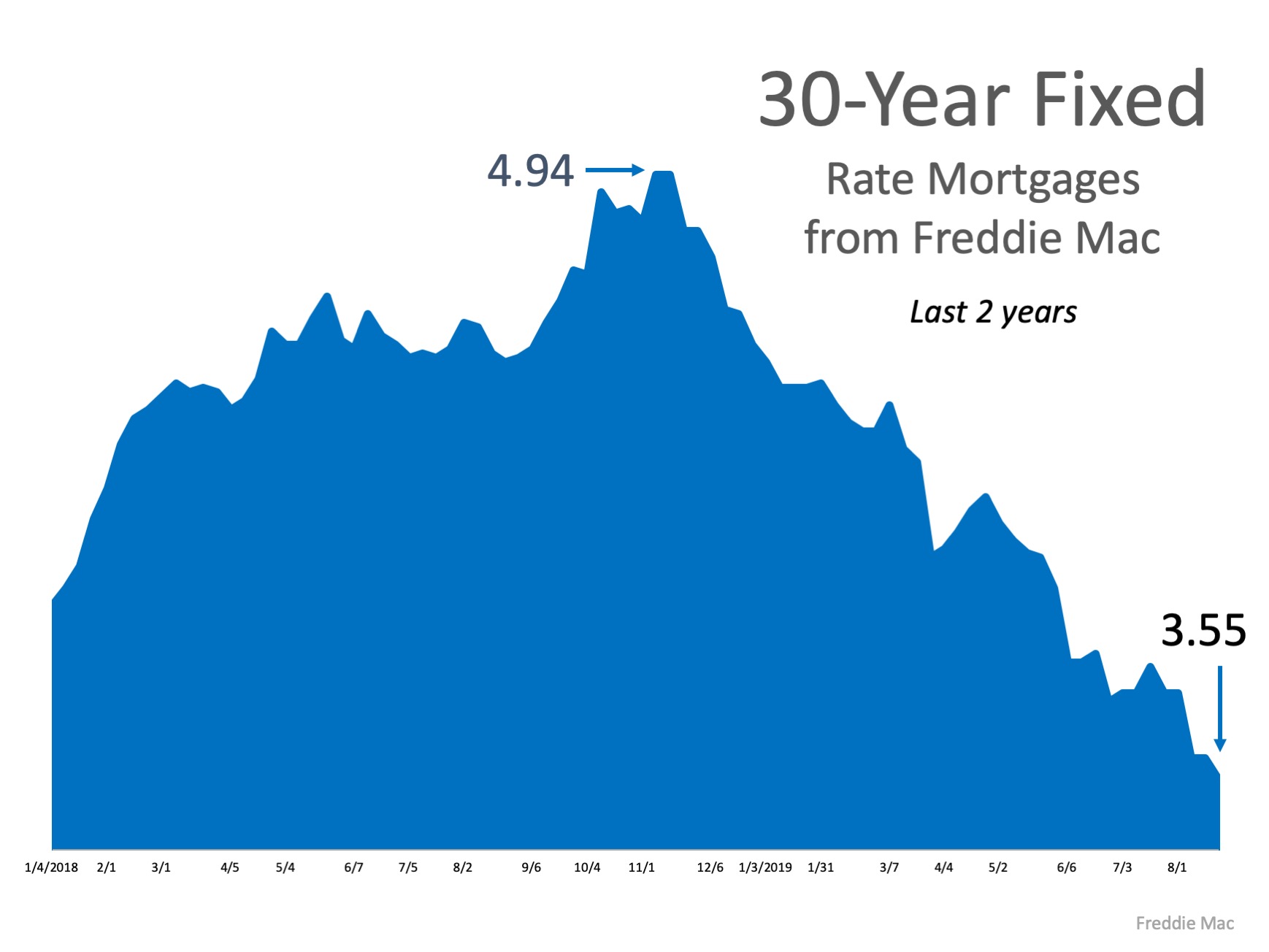

Mortgage rates have fallen by over a full percentage point since Q4 of 2018, settling at near-historic lows. This is big news for buyers looking to get more for their money in the current housing market.

According to Freddie Mac’s Primary Mortgage Market Survey,

According to Freddie Mac’s Primary Mortgage Market Survey,

“the 30-year fixed-rate mortgage (FRM) rate averaged 3.60 percent, the lowest it has been since November 2016.”

Sam Khater, Chief Economist at Freddie Mac, notes how this is great news for homebuyers. He states,

“…consumer sentiment remains buoyed by a strong labor market and low rates that will continue to drive home sales into the fall.”

As a potential buyer, the best thing you can do is work with a trusted advisor who can help you keep a close eye on how the market is changing. Relying on current expert advice is more important than ever when it comes to making a confident and informed decision for you and your family.

Bottom Line

Even a small increase (or decrease) in interest rates can impact your monthly housing cost. If buying a home is on your short list of goals to achieve, let’s get together to determine your best move.

source https://www.simplifyingthemarket.com/en/2019/08/27/whats-the-latest-on-interest-rates/?a=489394-750b3ad95b7715aa39b3f5a8d59f5d51

Comments

Post a Comment